January 18, 2024

Texas Real Estate Agents: Embrace New LLC Opportunities for Tax Efficiency in 2024

Navigating the New Tax Landscape: How LLCs Can Benefit Texas Real Estate Agents

Great news for real estate agents in Texas. This year, a groundbreaking change hit the market with news from the Texas Real Estate Commission. Starting January 2024, agents will now be able to receive their commission into an LLC. This offers a new, efficient way for agents to manage their taxes and run their businesses more effectively.

The Big Change:

Historically, real estate agents in Texas faced limitations in how they could structure their businesses for tax purposes. However, the upcoming change allows agents to set up a Limited Liability Company (LLC) and elect to file as an S Corporation.

This shift provides a substantial opportunity to reduce self-employment tax liabilities, a crucial aspect of financial planning and business management.

The recent changes allowing business entity registration for Texas real estate agents stem from Senate Bill 1577, enacted by the 88th Texas Legislature. This bill modifies The Real Estate License Act (TRELA) and now exists alongside the business entity real estate broker license.

Why This Matters:

For self-employed real estate agents, tax management is a critical component of their business strategy. Using an LLC and elect S Corporation status can lead to significant tax savings and increasing net income/take-home pay.

At Formations, the agents we structure as LLCs with S Corp elections see an average of 10-15 thousand in savings annually from this move alone.

The Difference Between Business Entity Registration Versus Business Entity License

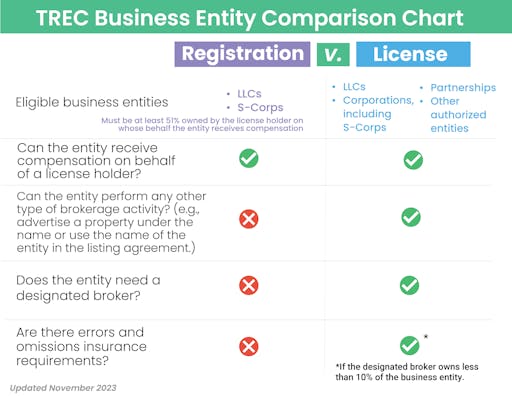

The comparison chart below, provided by TREC, effectively highlights the distinctions between the business entity registration and the business entity broker license. The business entity broker license used to be the only way real estate professionals could structure their self-employed venture into a proper business entity and receive income through it.

That all changes now with Senate Bill 1577, but there are still key differences between the two.

How to Create and Register Your LLC

You will need to create an entity (LLC) and register it with the TREC. The registration process will take place entirely online. For a list of steps, please visit the TREC website, or consult with a tax professional.

Schedule a ConsultationIt's important to note, you may only begin using your business entity to receive compensation once TREC approves your registration application.

Don’t Wait to Take Advantage of Tax Savings

This change is a game-changer for Texas real estate agents looking to optimize their tax strategy and strengthen their business's financial health. By taking proactive steps now, agents can position themselves to take full advantage of these new opportunities in 2024.

If real estate is your career, and you see consistent commissions year over year, it’s time to take a proactive step toward managing your tax liability. Don’t spend another year overpaying on taxes.

Curious if an S Corp is right for you?

Try our S Corp Tax Calculator to view potential savings.

S Corp Tax Calculator